BUSINESS BANK ACCOUNT

Ready for business

Powerful and simple. Apply today through Tide to open an FSCS protected bank account provided by ClearBank.

Open an accountCredit Card

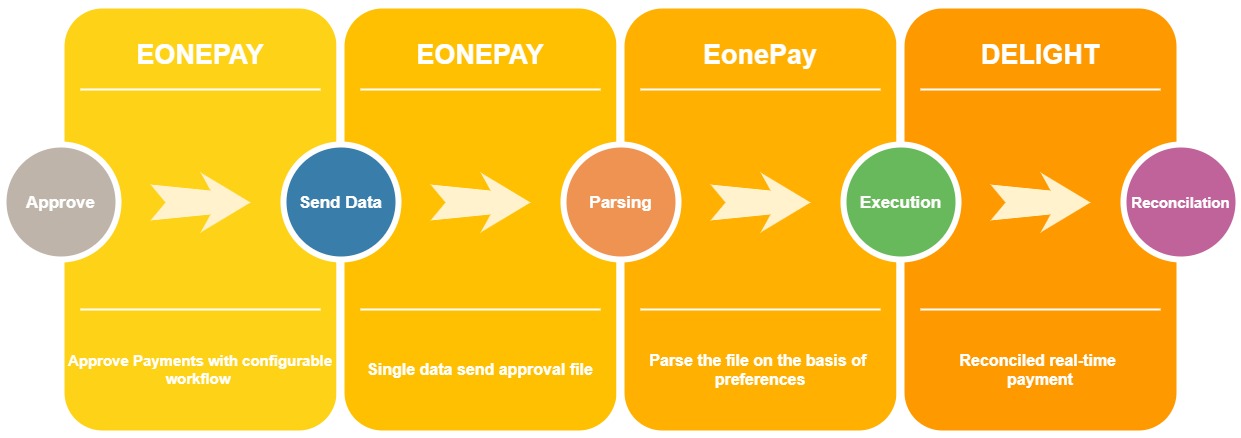

We make it easy for you to deliver payments and for your customers to receive payments. Customer can pay through a self-service portal after submitting documents, digital signatures and selecting their payment preference from either a direct deposit or Instant Payment, like EoneCard Send, streamlining the process for all.

Eonepay account is an e-money account provided by Prepay Solutions (PPS), a trading name of Prepay Technologies Ltd which is an electronic money institution authorized by the Financial Conduct Authority under the Electronic Money Regulations for the issuing of electronic money. PPS holds an amount equivalent to the money in Eonepay current accounts in a safeguarding account which gives customers protection against PPS’ insolvency. A payments technology solutions for financial institutions, technology companies, and businesses. We provide innovative payment solutions for business-to-business (B2B) payments, business-to-consumer payments , can be customized for industries

The flexible technology platform automates administrative workflows—interactive messaging, attachments, digital signatures, dynamic ID verification—and relieves regulatory compliance burdens. We offer workflow solutions that streamline your processes so you can work confidently and close faster. Our efficiency in digital documentation lets you spend more time cultivating and nurturing the important relationships that grow your business.

A account that's free, easy to open, and helps you start doing what you love. Access your account on the move, create customized invoices, integrate with your accounting software and manage your expenses all in the one app. Spend less time on admin and more time doing what you love. Our Aim is to bring the latest in payment innovation to enable financial institutions, technology partners, payments networks, payment facilitators, and businesses of all sizes.

Features

- Free Business MasterCard & management

- Eliminate Manual Process

- Simplify the Revenue cycle Management

- Low Cost & Fewer fraud cases

- No Delay ,with Cash Back

- Real time updates on payment

- Provide a seamless Customer Experience

- Streamline the Re-association of Payments & Remittance Details

- Reduce Costs Associated with Collecting Payments, Invoice Posting & Inefficient Operations

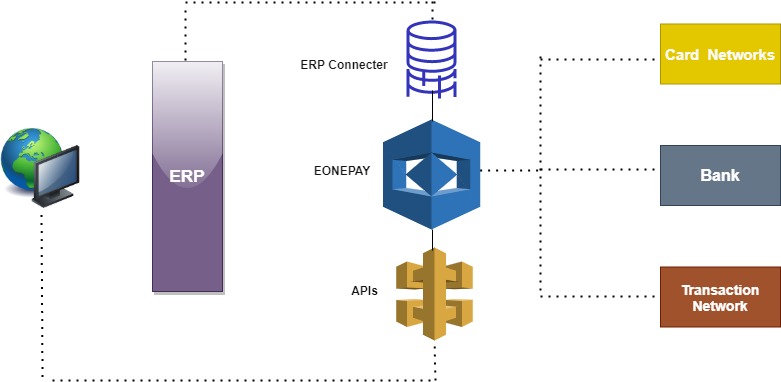

Eonepay makes frictionless B2B payments as a reality by unveiling an B2B automation platform that digitally connect buyers and suppliers through their banks and ERP platforms.Eonepay credit solution achieves fast growth with its prepaid card solutions for financial institutions.Eonepay leadership team brings proven expertise in financial product development and marketing, intelligent database architecture design, regulatory navigation, analysis and revenue growth

Account plans that scale with your business

For companies of all shapes and sizes

Freelancers

Straightforward business current accounts at no monthly cost to get started for sole traders, consultants and contractors

Small businesses

Limited companies save time with accounting integration, invoicing directly from the app and Expense Cards for easy expense management

Scaling businesses

Upgrade to our Plus or Premium memberships when your business needs more support and enjoy exclusive perks

More than just an account

Our business current account is packed with features which save you time and money:

Auto-categorisation

We automatically tag your income and spending. Customise the labels to suit your company.

Easy expenses

Upload receipts, auto-match them to transactions, add a note if you like and it’s all stored digitally.

Sync with accountancy software

Link your account to software like Xero, QuickBooks, Sage and more.

Send, pay and track invoices

No need for a separate system, keep on top of your invoices directly in our app.

Easy account access

Export CSV files

Download all your payments, attachments and notes, then upload them to any accounting software.

Sync up with your accounting software

Forget uploading CSVs – connect your account to Xero, QuickBooks, FreeAgent, Sage, KashFlow and Reckon.

Desktop access

Manage your finances in a way that works for you, whether it’s in the palm of your hand, or from your computer.

Read access for your team

Invite business partners, colleagues or your accountant to view and download transactions.

Contactless Mastercard

We’ve made it easy to manage your Tide card so you stay in control.

Free business Mastercard

Spend on your card in the UK and abroad with no fees and no commission. (Getting cash from an ATM costs £1 and some machines might charge an extra fee.)

Instant card management

Stay in control from anywhere. Use the app to freeze, unfreeze, or cancel and re-order your card.

Company expense cards

Order up to 35 Tide Expense Cards for your team and keep track of who's spending what. Set up sub-accounts to ringfence money for expenses.

Use everywhere

Spend in shops, buy online and withdraw cash worldwide wherever Mastercard is accepted.

Plus everything else you might need

Rapid setup

Get a sort code and account number in minutes.

Protected and trusted

We’re fully authorised and regulated by the FCA.

In-app support

Our Member Support team are available to help 24/7, 365.

Getting started is easy

No queuing or appointment required

1

Download the app

On play store or app store

2

Tell us about your company

Like what you do and any shareholders

3

Scan your ID and take a selfie

To securely verify who you are

4

Most accounts approved in minutes

Sometimes we ask for more information

Download the app

Your account is ready to go, we’ll get your card to you in a couple of days

A business bank account that's free, easy to open, and helps you start doing what you love.

EONEPAY is about doing what you love. That’s why we’re trusted by 300,000+ UK businesses.

Opne an account