EONEPAY Solutions offers bundled solutions built from the business service ecosystem to solve complex payment ecosystem. Working hard to expand its lending services to their customer base, allowing them to purchase services with funds.

All solutions are extendable and interoperable with each other and with current systems, and may be quickly modified to fit customer needs.

Process any type of payment—from capture to clearing, whether batch or real-time, domestic or cross-border, RTGS, NEFT, UPI, IMPS and QR Code. Reduce processing expenses and increase profit margins.

In a single service ecosystem, unify payment processing and orchestration for all payment kinds. Consolidate connectivity, centralize processing, and speed up the development of new consumer value offerings.

To capture and preprocess payments, mediate between several bank channels while keeping existing systems for ultimate execution. Fast-track payments modernization to meet market demand while protecting and extending the life of existing systems.

By automating and optimizing corporate to bank connectivity, you can onboard corporate customers faster and gain new clients. Without the need for custom programming, handle sophisticated corporate payment, statement, and acknowledgement file and message formats.

Deploy new real-time value-added services and experiences for all of your consumers 24×7. Connect to a variety of domestic and regional real-time clearinghouses to manage liquidity in real time.

Connect to over one hundred clearing and settlement mechanisms throughout the world quickly and effortlessly, all while maintaining full compliance.

Strengthen customer relationships through open banking business models, while complying with banking regulation. APIs for account access, payment initiation and other banking services.

One solution for all cross-border payment clearing and settlement needs, from traditional SWIFT transfers to alternative mechanisms.

Accelerating the transition from paper to digital and expanding financial inclusion by allowing corporations to pay any beneficiary, the way they want to be paid.

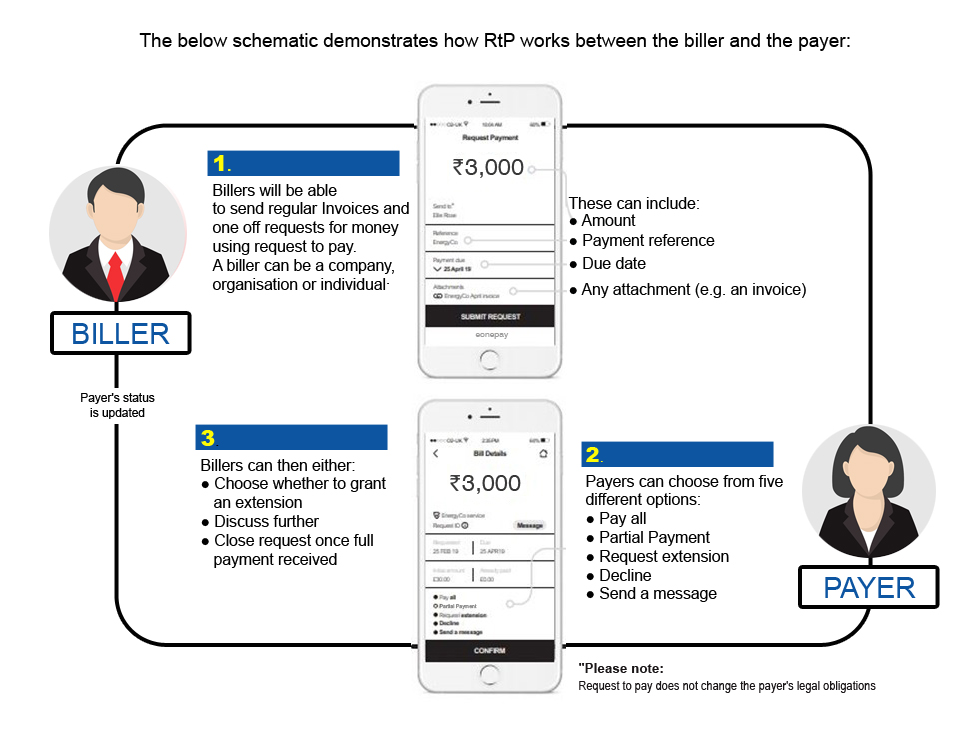

Request to pay are real-time, suitable for single or Ad Hoc payments and they do not require an upfront mandate from the payer. This is also an upgrade of E-Invoice& Payment, allowing the payer to approve and execute the requested payment in real time. This is a common process used by companies to collect payments electronically over the internet.

"Open Banking in the context of payments through bank accounts, Real time payment and Request to pay are like two sides of the same coin."

Platform for ecosystem integration and business services

● Hundreds of financial messaging standards, plug-ins, transformations, and client and server-side APIs are maintained and increasing in our library

● Zero-code configuration

● Automatically generates documentation and test scripts

● Easily integrate third-party services

● Deploy custom transformations

Technology Platform

● Micro services architecture

● Active-active deployment, zero downtime

● Real-time services 24x7x365

● -ISO 9001-2015

● Cloud ready

● Best-in-class performance

● Supports SQL and no SQL databases

Working collaboratively with trusted and creative fin tech, we're laying the groundwork for an integrated payments ecosystem that will meet both today's and tomorrow's needs.

Well-run accounts payable department may make or break a company. When it comes to receiving and processing bills, paying suppliers, and controlling spending, they do the heavy lifting. However, because many of the operations in accounts payable are done manually, they're typically laborious, time-consuming, and prone to errors, tying up your resources and potentially causing bottlenecks throughout the process. Payment automation is one of the current technologies that can help solve these challenges by enhancing productivity and removing the often tedious, manual processes required.

When it comes to automatic bill payment, we make it simple by offering a complete AP automation solution in four simple steps: capture, approval, authorization, and automatic bill payment.

To begin, simply scan invoices or have vendors send them to a specific email address. There's no need for time-consuming and error-prone manual entry. We use powerful OCR technology with human verification to extract header and line-level invoice details for guaranteed accuracy. We also offer API-level ERP connection, which allows you to sync invoice and payment data with your accounting software, all while having limitless document storage.

Payment automation has a number of advantages, one of which is cost savings. Businesses spend millions of dollars each year on manual AP processes, a large percentage of which is produced by paper checks, and processing a paper invoice takes an average of five working days at a cost. Payment automation not only speeds up the process and increases efficiency, but it also does it at a lower cost.

Payment automation solutions assist your organization's business continuity plan by allowing your staff to complete payments processes at any time and from any location. Because many firms have gone entirely remote in recent years, the ability to enable this process remotely has proven to be very useful.

With payment automation, organizations can determine precisely when and how they pay their vendors to ensure maximum control over outgoing cash flow. This allows businesses to capitalize on early-pay discounts and virtual card rebates, while also avoiding late fees and duplicate payments.

With complete access into the payments process, accounting managers are able to maintain a 360-degree view into the status of all payments at any given time. Automatic reconciliation capabilities allow for a fully automated daily bank reconciliation of your cash accounts, eliminating the need for manual intervention.

With automated payments, all invoices travel through one online process. Because of this, accounting managers have complete visibility into every payment, at every step of the process, allowing them to more effectively mitigate fraud risks as they arise. Further, integrated payables solutions can help to reduce the risk of fraud by maximizing e-payment methods and leveraging security features like encryption, two-factor authentication, audit trails, and fine-grained access controls.

The manual payment process is not only tedious, costly, and inefficient, but it also brings with it certain layers of risk that can be mitigated with an automated solution. Invoice-to-Pay sees efficiency for both AP and payments processing. In addition, by building simple, repeatable and scalable payment controls into their supplier payment process, they’re greatly reducing their risk of fraudulent activity.

By investing in a payment automation solution, you’re also freeing up your staff for more strategic thought and initiatives, centralizing all of the accounts payable operations, making room for more timely payments and effortless follow-up with customers, and simplifying transitions between each step of accounts payable.